Jun 9

Is this the week we see Bitcoin challenge the $112K all-time high? Has retail sold off enough to justify pumping whale portfolios? We discuss crypto's top cap, along with Ethereum, XRP, and Solana, with Thinking Crypto in our latest market update!

Jun 6

📈 As crypto markets attempt to rally at the end of the work week, crypto networks continue to grow over time. Here are the total amount of holders for select top caps:

🪙 Ethereum $ETH: 148.38M Holders

🪙 Bitcoin $BTC: 55.39M Holders

🪙 Dogecoin $DOGE: 7.97M Holders

🪙 Tether $USDT: 7.79M Holders

🪙 XRP $XRP: 6.53M Holders

🪙 Cardano $ADA: 4.49M Holders

🪙 USD Coin $USDC: 3.30M Holders

🪙 Chainlink $LINK: 766.01K Holders

May 28

💸 Percent of Total Supply in Profit is a straightforward metric that shows how much of a cryptocurrency’s current circulating supply is held at a profit—meaning the coins were bought at a lower price than they’re worth today. Currently, some notable top caps' supply in profit stats look like:

🪙 Bitcoin $BTC: 98.4%

🪙 Ethereum $ETH: 71.5%

🪙 XRP $XRP: 98.3%

🪙 Dogecoin $DOGE: 77.9%

🪙 Cardano $ADA: 71.0%

🪙 Chainlink $LINK: 80.5%

Even a tiny gain like +0.00001% counts as being “in profit,” making this a simple, yes-or-no measurement of market positioning, for every single coin. It helps investors quickly understand whether most holders are likely feeling optimistic or jaded, based on how their holdings have performed since entering circulation.

As more coins are mined, we will naturally see each coin see more and more of its total supply in profit. But by measuring the ratio of the asset's total supply in profit, we get a clear long-term picture of the market mood at a given moment because it focuses only on the currently available supply. Since crypto supply often increases over time, using percentages avoids misleading conclusions and helps investors gauge whether a coin is relatively overbought or oversold.

When combined with other metrics like MVRV (Market Value to Realized Value), RSI (Relative Strength Index), or Network Realized Profit/Loss, Percent in Profit becomes even more powerful. Crypto is a zero-sum game. So when large portions of a network are heavily in profit, the odds of profit-taking and a short-term pullback rise. But when most holders are sitting at a loss, it often indicates fear, undervaluation, and a potential opportunity to enter or add to a position before a price recovery.

May 23

Despite the all-time high celebrations, crypto never sleeps. And making the most informed decisions from here will likely come down to following key whale wallets and avoiding crowd think. We talk markets with Thinking Crypto.

May 12

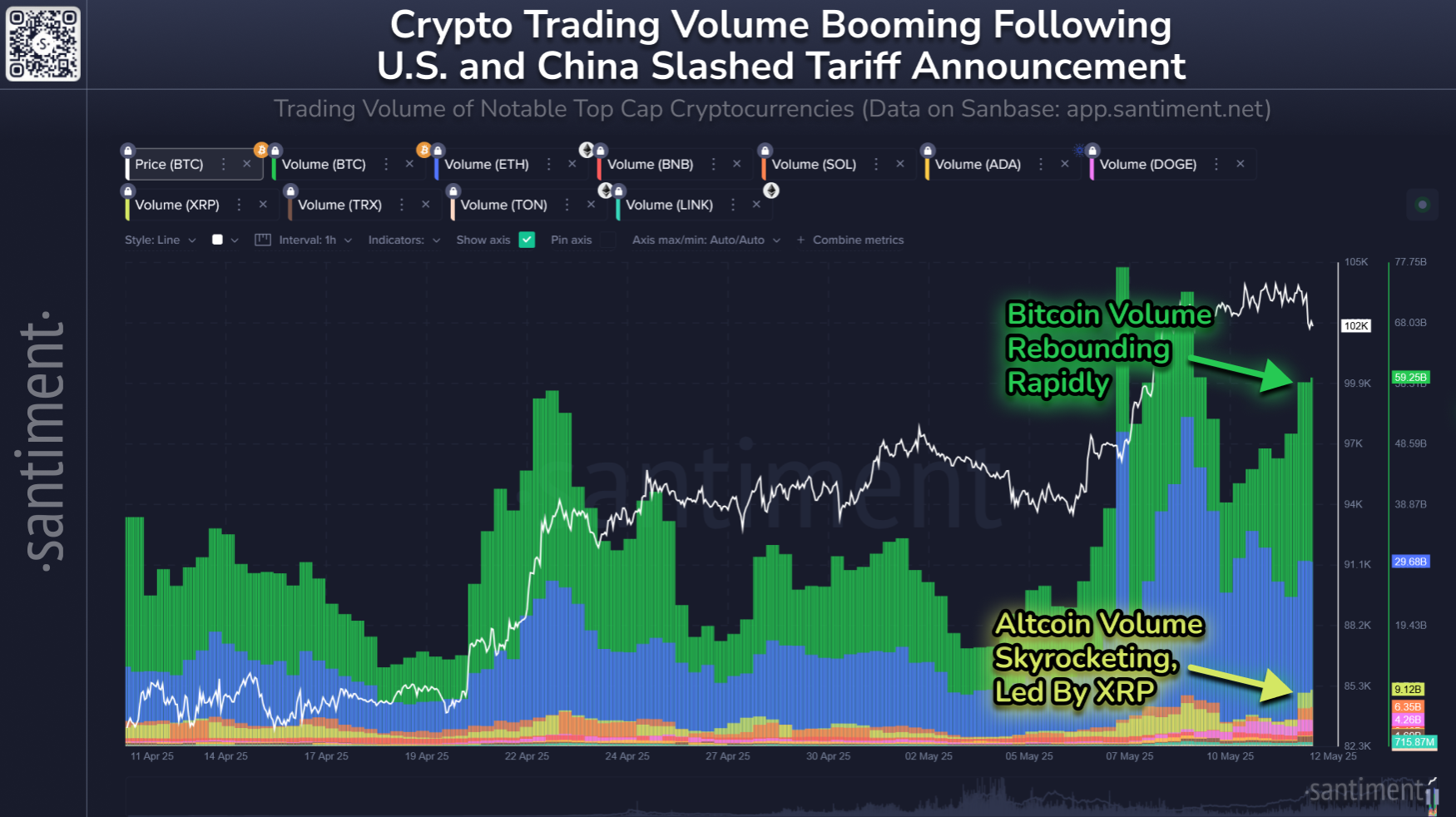

📊 Crypto trading volume has been rising substantially Monday, with retail traders positively responding to the news of the U.S. and China reaching an agreement to drop tariffs for 90 days as their negotiations continue for a long-term solution.

Prices have been lagging a bit compared to the massive +3.1% S&P 500 reaction to the news. But don't be surprised if cryptocurrency plays a bit of catch-up with rising volumes and institutional investors planning their next moves. 👌

📈 XRP has just surpassed Tether for the #3 market cap spot among all cryptocurrencies. The asset's market value is now back above $2.61 for the first time since March 6th. There are a few attributable reasons that the popular altcoin has enjoyed a mild decoupling from the pack:

- House bill 594, which would make Missouri the first U.S. state to offer a full income tax deduction on all capital gains

- XRP's amount of holders has grown by +11% thus far in 2025 alone

- XRP is now accepted as a payment method on Travala.com

Apr 29

💸 Gemini Dollar's level of supply on exchanges has skyrocketed from just under 48% to just over 62%, largely due to $6.6M worth of transfers around 7 hours ago from a whale, moving 10% of the entire $GUSD supply from a cold wallet to Gemini. Historically, stablecoin whale movement is a strong signal of planned purchases of traditional cryptocurrencies, such as Bitcoin, Ethereum, or XRP.

This could be a strong sign of another breakout, assuming world economies stay relatively stable and retail traders don't get overly greedy as prices creep up. Monitor the biggest whale transfers to centralized exchanges, and sort by the largest value transactions, highest percentage of a coin's market cap, which are the most recent, and plenty more on this FREE Santiment dashboard.

Mar 19

📈 XRP has decoupled from the altcoin pack, surging another +14% and breaching the $2.50 resistance for the first time in 12 days. Wallets with at least 1M $XRP now hold 46.4B coins, as they have accumulated 6.5% more in just the past 2 months alone. Address activity has also exploded in the month of March, seeing approximately 6x more unique wallets interacting on the network in March compared to earlier months.

It goes without saying that this price boost is also directly correlated with the SEC officially dropping its appeal against Ripple today. Ripple CEO Brad Garlinghouse has already deemed this a 'resounding victory' for the entire crypto community. 👍

Mar 16

📺 Our latest video with Thinking Crypto takes a look at some of the rebounds in crypto, and whether they have some staying power this time around. We also deep dive on metrics for Bitcoin, Ethereum, XRP, and Solana.

Mar 12

📊 Crypto-wide trading volume has been dropping since its peak back on February 27th (when traders were optimistically buying dipping prices). After further market cap declines these past two weeks, trader behavior indicates a mix of exhaustion, hopelessness, and capitulation.

When trading volume for major cryptocurrencies consistently drops, even during slight price recoveries (like we have seen Wednesday), it typically points toward diminishing trader enthusiasm. In this scenario, traders are becoming cautious, suggesting they might not believe that the current upward price movements will last. Essentially, reduced trading activity reflects uncertainty, as fewer traders are convinced that buying at current levels will yield profitable outcomes.

Moreover, a weakening trading volume amid mild price bounces can serve as an early warning sign of weakening market momentum. Without robust buying participation, price gains can quickly lose steam, as there simply isn’t enough underlying support to sustain the upward trend. This leads to the possibility that any rebound could be temporary, with prices vulnerable to another downturn. Shrinking volume during minor rebounds isn't necessarily a direct bearish signal, but volume is a metric that measures participation from both retail and institutional traders. If both groups are waiting for the other to boost market caps in order to make their next moves, it can lead to price stagnancy with little movement (and a slight tendency to veer toward the downside).

To signal a healthier and more sustainable recovery, bulls generally will want to see both rising prices and rising volumes simultaneously. Until trading activity increases meaningfully, cautious market sentiment is likely to dominate.