May 28

💸 Percent of Total Supply in Profit is a straightforward metric that shows how much of a cryptocurrency’s current circulating supply is held at a profit—meaning the coins were bought at a lower price than they’re worth today. Currently, some notable top caps' supply in profit stats look like:

🪙 Bitcoin $BTC: 98.4%

🪙 Ethereum $ETH: 71.5%

🪙 XRP $XRP: 98.3%

🪙 Dogecoin $DOGE: 77.9%

🪙 Cardano $ADA: 71.0%

🪙 Chainlink $LINK: 80.5%

Even a tiny gain like +0.00001% counts as being “in profit,” making this a simple, yes-or-no measurement of market positioning, for every single coin. It helps investors quickly understand whether most holders are likely feeling optimistic or jaded, based on how their holdings have performed since entering circulation.

As more coins are mined, we will naturally see each coin see more and more of its total supply in profit. But by measuring the ratio of the asset's total supply in profit, we get a clear long-term picture of the market mood at a given moment because it focuses only on the currently available supply. Since crypto supply often increases over time, using percentages avoids misleading conclusions and helps investors gauge whether a coin is relatively overbought or oversold.

When combined with other metrics like MVRV (Market Value to Realized Value), RSI (Relative Strength Index), or Network Realized Profit/Loss, Percent in Profit becomes even more powerful. Crypto is a zero-sum game. So when large portions of a network are heavily in profit, the odds of profit-taking and a short-term pullback rise. But when most holders are sitting at a loss, it often indicates fear, undervaluation, and a potential opportunity to enter or add to a position before a price recovery.

Apr 29

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's rank rise or fall since last month:

📈 1) iExec RLC $RLC 🥇

📉 2) Internet Computer $ICP 🥈

📉 3) Chainlink $LINK 🥉

📉 4) Starknet $STRK

➡️ 5) Cardano $ADA

📉 6) Optimism $OP

📈 7) Deepbook $DEEP

📈 8) Sui $SUI

📉 9) Ethereum $ETH

📈 10) zkSync $ZK

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading!

Apr 1

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Internet Computer $ICP 🥇

➡️ 2) Chainlink $LINK 🥈

📈 3) Starknet $STRK 🥉

📉 4) Optimism $OP

📉 5) Cardano $ADA

📈 6) iExec RLC $RLC

➡️ 7) Ethereum $ETH

📈 8) Avalanche $AVAX

📉 T9) Polkadot $DOT

📉 T9) Kusama $KSM

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading!

Mar 28

📉 Trading volume among crypto's 10 largest stablecoins has dropped to roughly 1/4th of the level we saw in the midst of the bull cycle in early December. Several factors are contributing to this:

📌 Trader Fatigue: Following the all-time high top back on January 19th, both institutional and retail traders have increasingly moved capital and taken profits while awaiting new catalysts.

📌 There have been new regulatory announcements in major markets, raising the level of uncertainty and causing traders of all sizes to take more of a 'hodling' approach for the time being

📌 Bitcoin's supply on exchanges recently reached a 7-year low, indicating trader contentment with executing less on-chain trading on a daily basis

Mar 7

🐳 With altcoins continuing to increase their market caps as the week draws to a close, pay attention to the networks seeing the highest rises in the amount of $100K+ whale transactions:

🪙 1) Aave (On Polygon) $AAVE: +267%

🪙 2) HEX $HEX: +256%

🪙 3) OKX $OKB: +200%

🪙 4) Cardano $ADA: +193%

🪙 5) Optimism $OP: +140%

🪙 6) Trillioner $TLC: +133%

🪙 7) Bitcoin Cash $BCH: +128%

🪙 8) Curve $CRV: +100%

🪙 9) Bitdao $BIT: +100%

🪙 10) Gate $GT: +100%

These projects could see significant over-performances throughout the next few weeks if markets continue to rally due to signs of potential accumulation coming from many of these increased whale transfers.

Feb 24

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Internet Computer $ICP 🥇

📈 2) Chainlink $LINK 🥈

📈 3) Optimism $OP 🥉

📉 4) Cardano $ADA

➡️ 5) Starknet $STRK

📉 6) Hedera $HBAR

📈 7) Ethereum $ETH

📉 T8) Polkadot $DOT

📉 T8) Kusama $KSM

📈 10) Eigenlayer $EIGEN

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading.

Feb 11

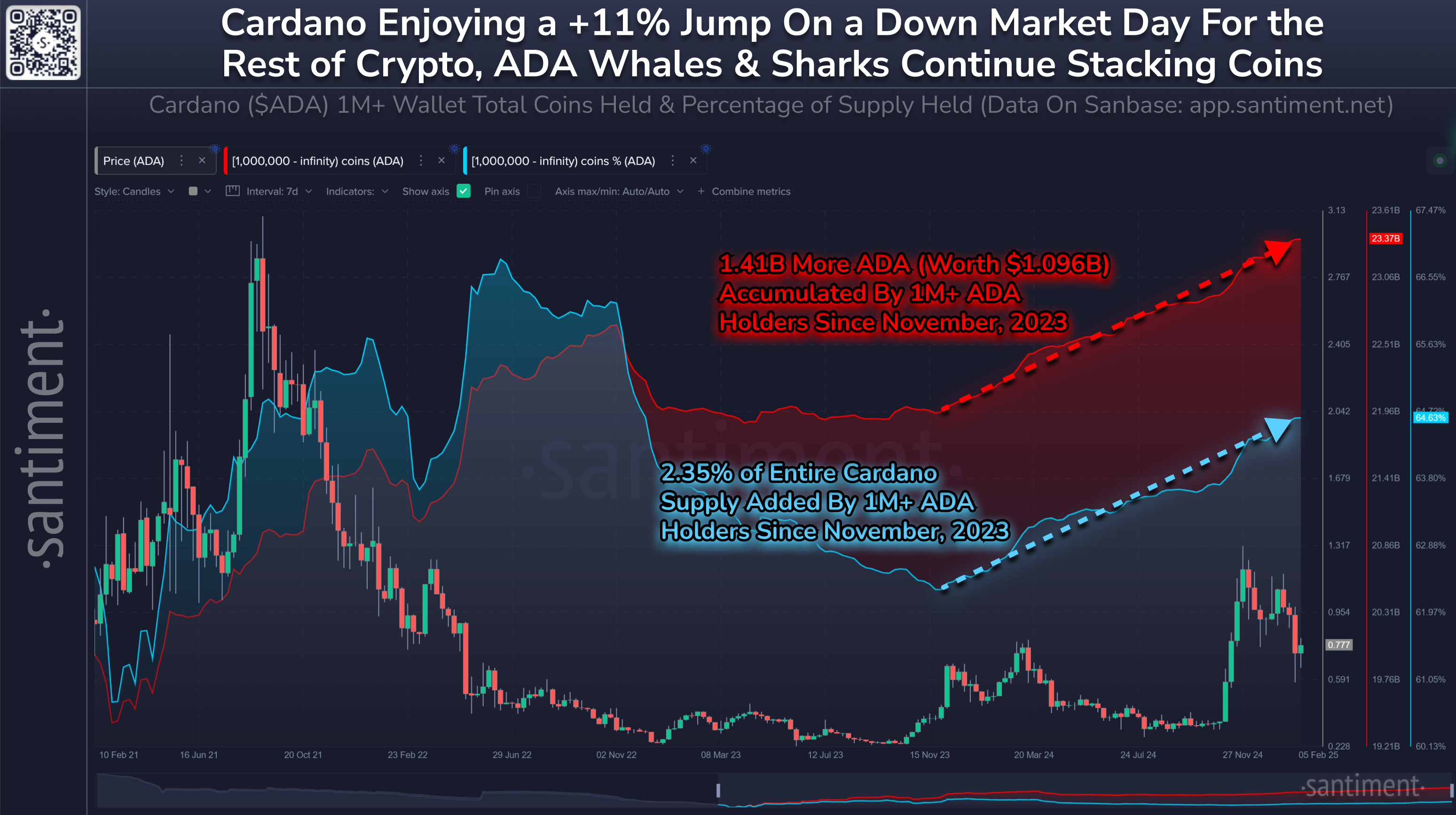

📊 In terms of cryptocurrency discussions on X, Reddit, Telegram, 4Chan, Bitcointalk, and Farcaster, Bitcoin (in teal) is leading the way as usual. Cardano (in pink) is seeing a massive rise compared to usual, while Ethereum (red) and Dogecoin (orange) are nearly non-existent.

🐳📈 Cardano's market cap has recovered by +11% on a day where most cryptocurrencies have retraced.

One thing to continue watching is the continued behavior of whales and sharks. Wallets holding at least 1M $ADA have been consistently accumulating since late November of 2023, adding 1.41B more coins and 2.35% of the entire supply during this 15-month stretch.

Through all of the volatility, the altcoin's price has grown by +107% since this whale and shark accumulation cycle began. 👍

Jan 28

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Internet Computer $ICP 🥇

📈 2) Hedera $HBAR 🥈

📈 3) Cardano $ADA 🥉

📉 4) Chainlink $LINK

📉 5) Starknet $STRK

➡️ 6) Optimism $OP

➡️ 7) Polkadot $DOT

➡️ 8) Kusama $KSM

📈 9) Ethereum $ETH

📈 10) Deepbook $DEEP

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading!

Jan 15

🥳 With crypto coming to life again on Tuesday, commentary across social media reveals positive sentiment forming toward Solana, Dogecoin, and Cardano.

🤔 Meanwhile, things are much more polarized for top 3 assets Bitcoin, Ethereum, and XRP.