Jun 10

🧑💻 While most of crypto stays flat Tuesday, Chainlink (+7.7%) and Ethereum (+6.3%) have continued to break out. These two projects are known for their top ranked developing teams. Over the past 30 days, $LINK has had the 2nd most notable github events and $ETH is in 8th.

Jun 5

🧑💻 Here are crypto's top ETH-based coins by development activity. Directional indicators represent each project's ranking positioning since last month:

📈1) Chainlink $LINK 🥇

📈 2) Starknet $STRK 🥈

➡️ 3) Ethereum $ETH 🥉

📈 4) Eigenlayer $EIGEN

📉 5) Status $SNT

📈 6) sUSD $SUSD

📈 7) Synthetix $SNX

📉 8) Decentraland $MANA

📉 9) Lido DAO $LDO

📈 10) Lido Staked Ethereum $stETH 📖

Read about the Santiment methodology for filtering notable github activity data from project repositories, and why it is so useful for crypto trading!

May 28

💸 Percent of Total Supply in Profit is a straightforward metric that shows how much of a cryptocurrency’s current circulating supply is held at a profit—meaning the coins were bought at a lower price than they’re worth today. Currently, some notable top caps' supply in profit stats look like:

🪙 Bitcoin $BTC: 98.4%

🪙 Ethereum $ETH: 71.5%

🪙 XRP $XRP: 98.3%

🪙 Dogecoin $DOGE: 77.9%

🪙 Cardano $ADA: 71.0%

🪙 Chainlink $LINK: 80.5%

Even a tiny gain like +0.00001% counts as being “in profit,” making this a simple, yes-or-no measurement of market positioning, for every single coin. It helps investors quickly understand whether most holders are likely feeling optimistic or jaded, based on how their holdings have performed since entering circulation.

As more coins are mined, we will naturally see each coin see more and more of its total supply in profit. But by measuring the ratio of the asset's total supply in profit, we get a clear long-term picture of the market mood at a given moment because it focuses only on the currently available supply. Since crypto supply often increases over time, using percentages avoids misleading conclusions and helps investors gauge whether a coin is relatively overbought or oversold.

When combined with other metrics like MVRV (Market Value to Realized Value), RSI (Relative Strength Index), or Network Realized Profit/Loss, Percent in Profit becomes even more powerful. Crypto is a zero-sum game. So when large portions of a network are heavily in profit, the odds of profit-taking and a short-term pullback rise. But when most holders are sitting at a loss, it often indicates fear, undervaluation, and a potential opportunity to enter or add to a position before a price recovery.

May 19

🧑💻 Here are crypto's top ETH-based coins by development activity. Directional indicators represent each project's ranking positioning since last month:

➡️ 1) Chainlink $LINK 🥇

📈 2) Ethereum $ETH 🥈

📈 3) Synthetix $SNX 🥉

📈 4) sUSD $SUSD

📈 5) Status $SNT

📈 6) Lido DAO $LDO

📈 7) Livepeer $LPT

📈 8) Holo $HOT

📈 9) Decentraland $MANA

📈 10) Injective $INJ

📖 Read about the Santiment methodology for filtering notable github activity data from project repositories, and why it is so useful for crypto trading.

May 13

🧑💻 Here are crypto's top 10 DeFi projects by development. Directional indicators represent each project's ranking positioning since last month:

➡️ 1) Chainlink $LINK 🥇

📈 2) Deepbook $DEEP 🥈

📉 3) DeFiChain $DFI 🥉

➡️ 4) Synthetix\ $SNX

📈 5) Lido DAO $LDO

📈 6) Liquity $LQTY

📉 7) Coinbase Wrapped BTC $CBBTC

📈 8) Injective $INJ

📈 9) Babylon $BABY

➡️ 10) Uniswap $UNI

Read about Santiment's methodology for covering development activity for over 4,000 projects.

Apr 29

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's rank rise or fall since last month:

📈 1) iExec RLC $RLC 🥇

📉 2) Internet Computer $ICP 🥈

📉 3) Chainlink $LINK 🥉

📉 4) Starknet $STRK

➡️ 5) Cardano $ADA

📉 6) Optimism $OP

📈 7) Deepbook $DEEP

📈 8) Sui $SUI

📉 9) Ethereum $ETH

📈 10) zkSync $ZK

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading!

Apr 17

🧑💻 Here are crypto's top ETH-based coins by development activity. Directional indicators represent each project's ranking positioning since last month:

📈1) iExec RLC $RLC 🥇

📉 2) Chainlink $LINK 🥈

➡️ 3) Ethereum $ETH 🥉

📈 4) Status $SNT

📈 5) The Graph $GRT

📈 6) Decentraland $MANA

📈 7) Lido DAO $LDO

➡️ 8) sUSD $SUSD

📉 9) Synthetix $SNX

📈 10) Holo $HOT

📖 Read about the Santiment methodology for filtering notable github activity data from project repositories, and why it is so useful for crypto trading.

Apr 15

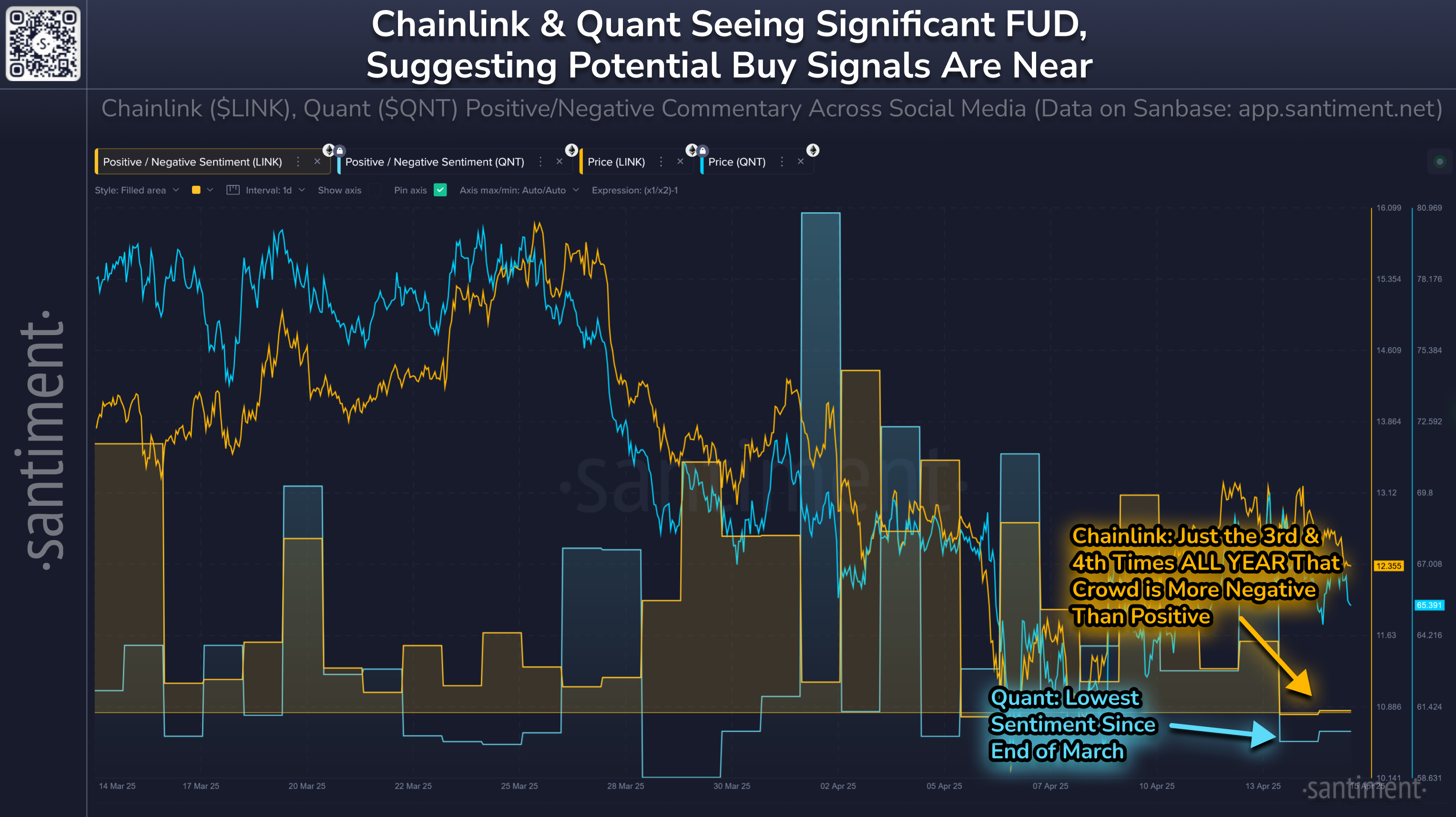

😮 As crypto markets range, keep an eye on the FUD forming around Chainlink and Quant. Their 3-week price dips have made traders grow impatient. Markets typically move the opposite direction of the crowd's expectations, increasing the likelihood of $LINK & $QNT bouncing soon.

Grab your free 2-week trial to Sanbase PRO and enjoy all sorts of professional-grade trading tools & indicators. See what others in crypto can't.

Apr 1

🧑💻 Here are crypto's top overall coins by notable development activity the past 30 days. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Internet Computer $ICP 🥇

➡️ 2) Chainlink $LINK 🥈

📈 3) Starknet $STRK 🥉

📉 4) Optimism $OP

📉 5) Cardano $ADA

📈 6) iExec RLC $RLC

➡️ 7) Ethereum $ETH

📈 8) Avalanche $AVAX

📉 T9) Polkadot $DOT

📉 T9) Kusama $KSM

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto research, investing, and trading!

Mar 28

🔗 Chainlink has seen a jump in social dominance across crypto social media following its hosting of a private meetup with key US government leaders. The #11 market cap has jumped +25% in value since March 10th.

🐳 Additionally, we are seeing growth from key stakeholder wallets that are holding between 10K to 10M $LINK. Wallets of this size now hold an all-time high 438.33M coins, making up 43.8% of the coin's entire supply.