Jun 10

🧑💻 Here are crypto's top Real World Assets (RWA's) by development. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Chainlink $LINK 🥇

➡️ 2) Avalanche $AVAX 🥈

➡️ 3) Stellar $XLM 🥉

➡️ 4) IOTA $IOTA

➡️ 5) Injective $INJ

➡️ 6) Axelar $AXL

➡️ 7) Chia $XCH

➡️ 8) Hedera $HBAR

➡️ 9) VeChain $VET

📈 10) Maker $MKR

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto trading.

May 22

🧑💻 Here are crypto's top Real World Assets (RWA's) by development. Directional indicators represent each project's ranking rise or fall since last month:

➡️ 1) Chainlink $LINK 🥇

📈 2) Avalanche $AVAX 🥈

📈 3) Stellar $XLM 🥉

📈 4) IOTA $IOTA

📈 5) Injective $INJ

📈 6) Axelar $AXL

📈 7) Chia $XCH

📈 8) Hedera $HBAR

📈 9) VeChain $VET

📉 10) Centrifuge $CFG

📖 Read about the Santiment methodology for pulling github activity data from project repositories, and why it is so useful for crypto trading.

Apr 15

🧑💻 Here are crypto's top 10 DeFi projects by development. Directional indicators represent each project's ranking positioning since last month:

📈 1) DeFiChain $DFI 🥇

📈 2) Synthetix $SNX 🥈 (On Ethereum)

📈 3) Lido DAO $LDO 🥉

📈 4) Liquity $LQTY

📈 5) Liquity USD $LUSD

📈 6) Injective $INJ

📈 7) Uniswap $UNI (On Ethereum)

📈 8) Foxcoin $FOX

📈 9) Curve $CRV (On Ethereum)

📈 10) Curve $CRV (On Arbitrum)

Read about Santiment's methodology for covering development activity for over 4,000 projects.

Apr 8

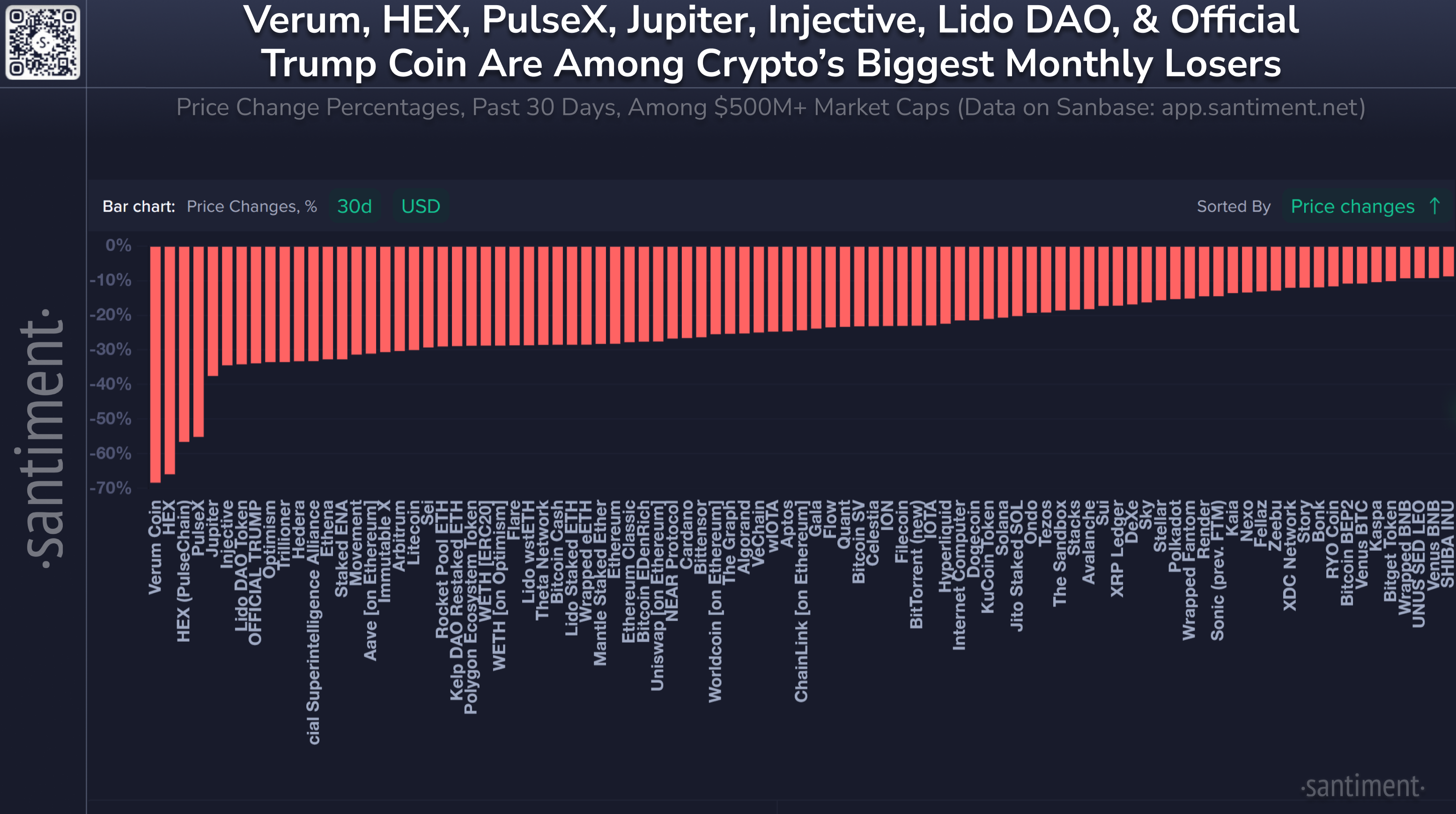

📉 As cryptocurrencies continue to feel the pain in a tumultuous 2025, here are the projects that have shed the most value by percentage (among $500M+ market caps) in the past 30 days:

🪙 Verum $VERUM: -68%

🪙 HEX $HEX: -56%

🪙 PulseX $PLSX: -55%

🪙 Jupiter $JUP: -38%

🪙 Injective $INJ: -34%

🪙 Lido DAO $LDO: -34%

🪙 Official Trump $TRUMP: -34%

🪙 Optimism $OP: -34%

🪙 Trillioner $TLC: -34%

🪙 Hedera $HBAR: -33%

Jan 13

🧑💻 Here are crypto's top 10 DeFi projects by development. Directional indicators represent each project's ranking positioning since last month:

➡️ 1) Chainlink $LINK 🥇

➡️ 2) Synthetix $SNX 🥈

➡️ 3) Deepbook $DEEP 🥉

📈 4) Injective $INJ

📉 5) Radix $XRD

📈 6) Curve $CRV

➡️ 7) Defichain $DFI

➡️ 8) Lido DAO $LDO

📉 9) dYdX $DYDX

📈 10) FOX $FOX

Read about Santiment's methodology for covering development activity for over 3,500 projects.

Jan 8

📊 Bitcoin sits at just under $97K, and Ethereum back below $3.4K. The first week of January has still been mostly a bullish rebound to crypto's fade at the end of 2024. Altcoins like Stellar (+26%), Injective (+24%), & Cardano (+19%) look to continue their strong weeks.

Nov 26

🧑💻 Here are crypto's top 10 DeFi projects by development. Directional indicators represent each project's ranking positioning since last month:

➡️ 1) Synthetix $SNX 🥇

📈 2) DeepBook $DEEP 🥈

📈 3) Radix $XRD 🥉

📈 4) Injective $INJ

📉 5) dYdX $DYDX

📈 6) Defichain $DFI

📈 7) Request $REQ

📉 8) Lido DAO $LDO

📉 9) Osmosis $OSMO

📉 10) Fox $FOX

Read about Santiment's methodology for covering development activity for over 3,500 projects!

Oct 16

🧑💻 Here are crypto's top 10 DeFi projects by development. Directional indicators represent each project's ranking positioning since last month:

➡️ 1) Synthetix $SNX 🥇

➡️ 2) dYdX $DYDX 🥈

➡️ 3) Lido DAO $LDO 🥉

➡️ 4) Injective $INJ

📈 5) Uniswap $UNI

📈 6) Fox $FOX

📉 7) Osmosis $OSMO

📈 8) Maker $MKR

📈 9) Origin $OGV

📈 10) Sora Validator Token $VAL

Read about Santiment's methodology for covering development activity for over 3,400 projects!

Sep 16

📊 Altcoins such as Injective (INJ), Render (RENDER), and Polygon (MATIC) are among several that saw plenty of price anomalies after whale exchange wallet supply suddenly shifted to whale cold wallet supply. These anomalies are fantastic as both short & long term signals.

Sep 10

🧑💻 Crypto's top 10 DeFi projects by development. Directional indicators represent each project's ranking positioning since last month:

➡️ 1) Synthetix $SNX 🥇

➡️ 2) dYdX $DYDX 🥈

📈 3) Lido DAO $LDO 🥉

📈 4) Injective $INJ

📉 5) Osmosis $OSMO

📈 6) Uniswap $UNI

📈 7) Fox $FOX

➡️ 8) Centrifuge $CFG

📉 9) Maker $MKR

📈 10) Origin DeFi Governance $OGV

Read about Santiment's methodology for covering development activity for over 3,000 projects.