Jun 20

📺 In our latest video with @ThinkingCrypto, we check out the on-chain & sentiment metrics behind Bitcoin, Ethereum, XRP, and Solana. See what others in crypto can't as we kick off a (hopefully) bullish summer.

Jun 16

📊 The XRP ledger is showing serious signs of growth, from both a usage and key stakeholder perspective.

📈 The amount of interacting $XRP addresses has averaged over 295K per day over the past week. Its normal daily average over the past 3 months was approximately 35-40K.

🐳 Additionally, there are now over 2,700 whale & shark wallets holding at least 1M $XRP for the first time in the asset's 12+ year history.

Jun 9

Is this the week we see Bitcoin challenge the $112K all-time high? Has retail sold off enough to justify pumping whale portfolios? We discuss crypto's top cap, along with Ethereum, XRP, and Solana, with Thinking Crypto in our latest market update!

Jun 6

📈 As crypto markets attempt to rally at the end of the work week, crypto networks continue to grow over time. Here are the total amount of holders for select top caps:

🪙 Ethereum $ETH: 148.38M Holders

🪙 Bitcoin $BTC: 55.39M Holders

🪙 Dogecoin $DOGE: 7.97M Holders

🪙 Tether $USDT: 7.79M Holders

🪙 XRP $XRP: 6.53M Holders

🪙 Cardano $ADA: 4.49M Holders

🪙 USD Coin $USDC: 3.30M Holders

🪙 Chainlink $LINK: 766.01K Holders

Jun 4

May 28

💸 Percent of Total Supply in Profit is a straightforward metric that shows how much of a cryptocurrency’s current circulating supply is held at a profit—meaning the coins were bought at a lower price than they’re worth today. Currently, some notable top caps' supply in profit stats look like:

🪙 Bitcoin $BTC: 98.4%

🪙 Ethereum $ETH: 71.5%

🪙 XRP $XRP: 98.3%

🪙 Dogecoin $DOGE: 77.9%

🪙 Cardano $ADA: 71.0%

🪙 Chainlink $LINK: 80.5%

Even a tiny gain like +0.00001% counts as being “in profit,” making this a simple, yes-or-no measurement of market positioning, for every single coin. It helps investors quickly understand whether most holders are likely feeling optimistic or jaded, based on how their holdings have performed since entering circulation.

As more coins are mined, we will naturally see each coin see more and more of its total supply in profit. But by measuring the ratio of the asset's total supply in profit, we get a clear long-term picture of the market mood at a given moment because it focuses only on the currently available supply. Since crypto supply often increases over time, using percentages avoids misleading conclusions and helps investors gauge whether a coin is relatively overbought or oversold.

When combined with other metrics like MVRV (Market Value to Realized Value), RSI (Relative Strength Index), or Network Realized Profit/Loss, Percent in Profit becomes even more powerful. Crypto is a zero-sum game. So when large portions of a network are heavily in profit, the odds of profit-taking and a short-term pullback rise. But when most holders are sitting at a loss, it often indicates fear, undervaluation, and a potential opportunity to enter or add to a position before a price recovery.

May 23

Despite the all-time high celebrations, crypto never sleeps. And making the most informed decisions from here will likely come down to following key whale wallets and avoiding crowd think. We talk markets with Thinking Crypto.

May 20

May 12

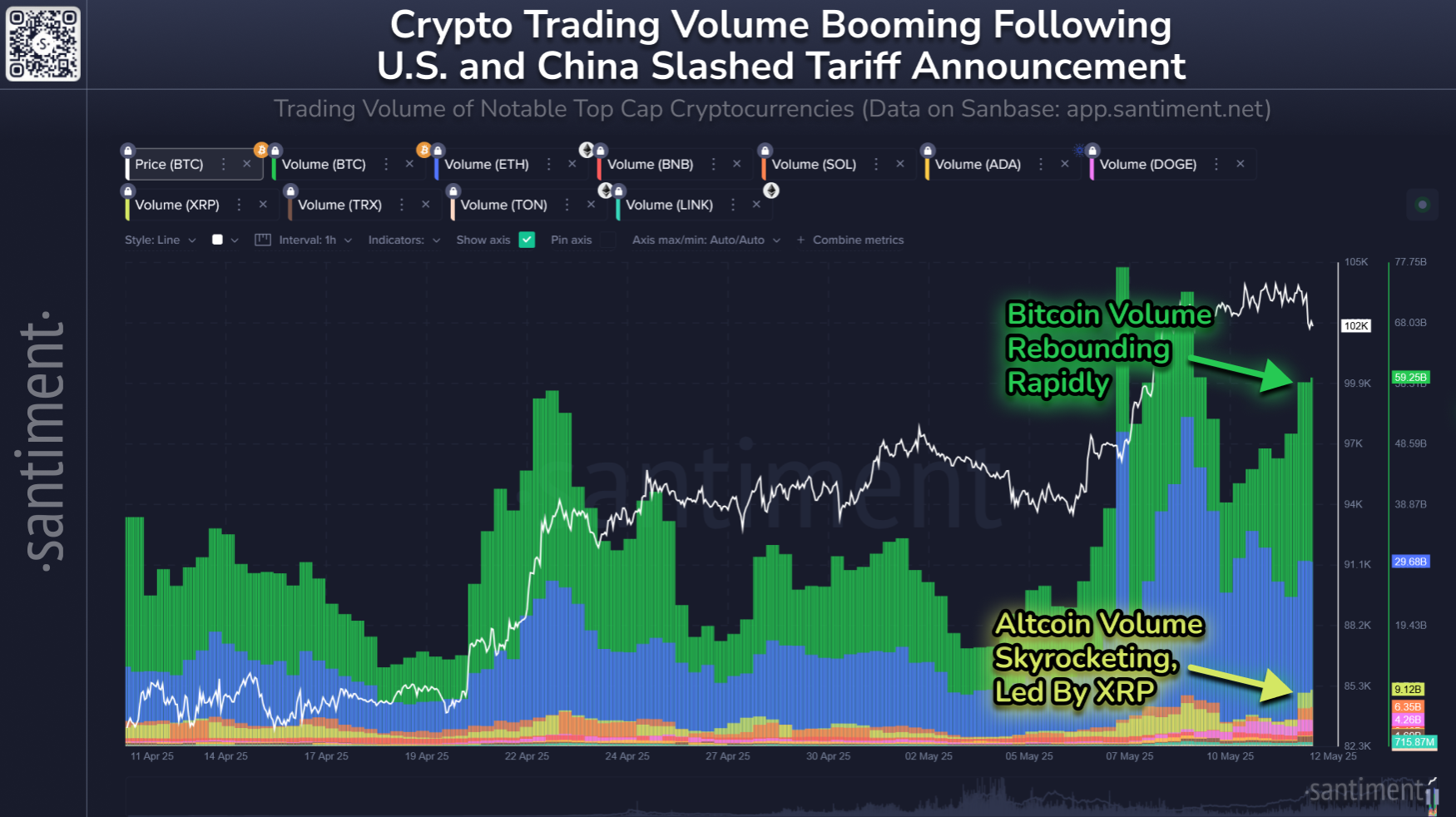

📊 Crypto trading volume has been rising substantially Monday, with retail traders positively responding to the news of the U.S. and China reaching an agreement to drop tariffs for 90 days as their negotiations continue for a long-term solution.

Prices have been lagging a bit compared to the massive +3.1% S&P 500 reaction to the news. But don't be surprised if cryptocurrency plays a bit of catch-up with rising volumes and institutional investors planning their next moves. 👌

📈 XRP has just surpassed Tether for the #3 market cap spot among all cryptocurrencies. The asset's market value is now back above $2.61 for the first time since March 6th. There are a few attributable reasons that the popular altcoin has enjoyed a mild decoupling from the pack:

- House bill 594, which would make Missouri the first U.S. state to offer a full income tax deduction on all capital gains

- XRP's amount of holders has grown by +11% thus far in 2025 alone

- XRP is now accepted as a payment method on Travala.com