Ethereum's Unprecedented Rally Has Traders Kicking Themselves

As crypto's #2 market cap was really hitting its peak mockery and "laughability" across social media just a couple of weeks ago, a funny thing happened... Ethereum began to rally like it was 2017 again. Since its local bottom of just under $1,800 back on May 7th, the coin's market value has now jumped +49% in just under the six days since.

For those who remember the "flippening" hype from back in the 2016–2017 era of crypto, the prevailing theory was that Ethereum would eventually overtake Bitcoin as the largest cryptocurrency by market capitalization. This belief stemmed from Ethereum’s rapidly growing developer ecosystem, its smart contract functionality, and the idea that its real-world utility could one day eclipse Bitcoin’s role as digital gold.

Although the flippening never fully materialized (at least 9 years after the movement started going viral), it sparked an ongoing debate about whether technological versatility could out-value first-mover dominance in the crypto space. And it isn't difficult to find many archived posts about the eventual market cap swap between ETH and BTC from back then.

We can really see how price calls across social media have done a complete 180 as doubters have been silenced by Ether's rally. For consistency, we have charted prices below what we have seen throughout May ($0-$1.5K) and above what we have seen in May ($3.5K to $5.0K). You can track it for yourself here.

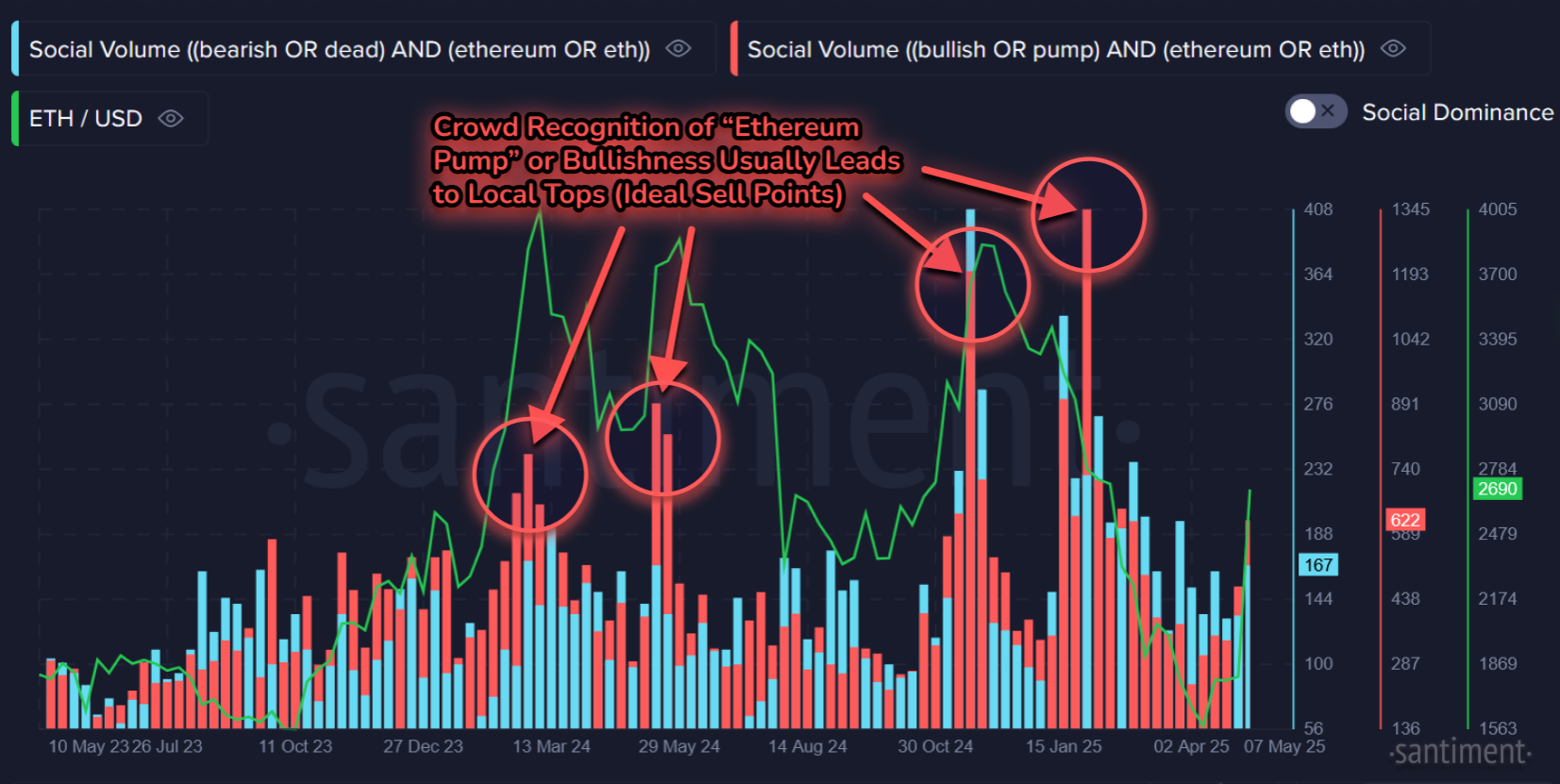

As you can see, the blue bars (representing bearish price calls) were surging on May 6th and 7th as it appeared that other assets were leaving Ethereum in the dust once again. But when the altcoin began to erupt on May 8th, it's quite clear how quickly the crowd's mood changed, as they began speculating for $3,500 and above.

This is the beauty of the irrationality of crypto, and why sentiment is such a vital indicator. Retail traders have, and will always be, in a very "what have you done for me lately" state of mind. The decision for many to trade and invest in cryptocurrencies (instead of the stock market) in the first place is often based on bigger risk and reward opportunities. And if an asset, especially one as large as Ethereum, has been under-performing for three years straight, of course retailers are going to think the trend will continue and dismiss it in favor of the latest meme coin hype cycles.

And with dismissal from the crowd, as we've seen many times, comes massive pumps that blindside the doubters. Take a look at the several instances of high rates of social media spamming on Ethereum bullishness or recognizing Ethereum pumps. It's pretty clear that overhype leads to overcorrection. And no, we are not seeing a heavy amount of euphoria just yet, which is a good sign this rally can continue.

Another thing to keep tabs on is how Ethereum's transaction fees. One of the (likely fair) criticisms of ETH's network is that it can get very expensive and congested when there is heavy demand. This creates a self-fulfilling prophecy of less people being willing to transfer Ethereum whenever it gets too popular and utilized. And alternatively, when the network is very low use, fees become miniscule, incentivizing people to come back and begin using the network again.

As of now, transfers are still at just an average of $0.84 fee per transfer. This is a far cry for the $7+ average fee back six months ago, as the above chart shows. There has been a steady decline as more and more traders have been turned off by Ethereum's price performance. But it will be important to watch if average fees rebound back up to $2 or more once again, which may indicate a cap on this rally.

If you are looking for a good opportunity to enter into Ethereum right now, it may be best to exercise patience. Average 30-day returns currently sit at +32.5%, which is well over the rule-of-thumb +15% danger zone we recommend for altcoins. It may not mean that prices are about to drop, but it does suggest that the rally will likely slow or halt until the 30-day MVRV dips back down to something more reasonable.

Overall, the long-term future is looking brighter for Ethereum (from the crowd's eyes) than we've seen in years. For fundamentalists who have never stopped believing in ETH's place in the crypto ecosystem, the major price run is simply validation of their patience, but doesn't change their long-term positive perception.

Expect short-term volatility due to all of the attention it's getting. And assuming Bitcoin makes its own run toward a $110K all-time high in the next month, Ethereum breaching $3,000 again would likely happen in tandem with that milestone.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.