Crowd Rapidly Turning Interests Back to Altcoins

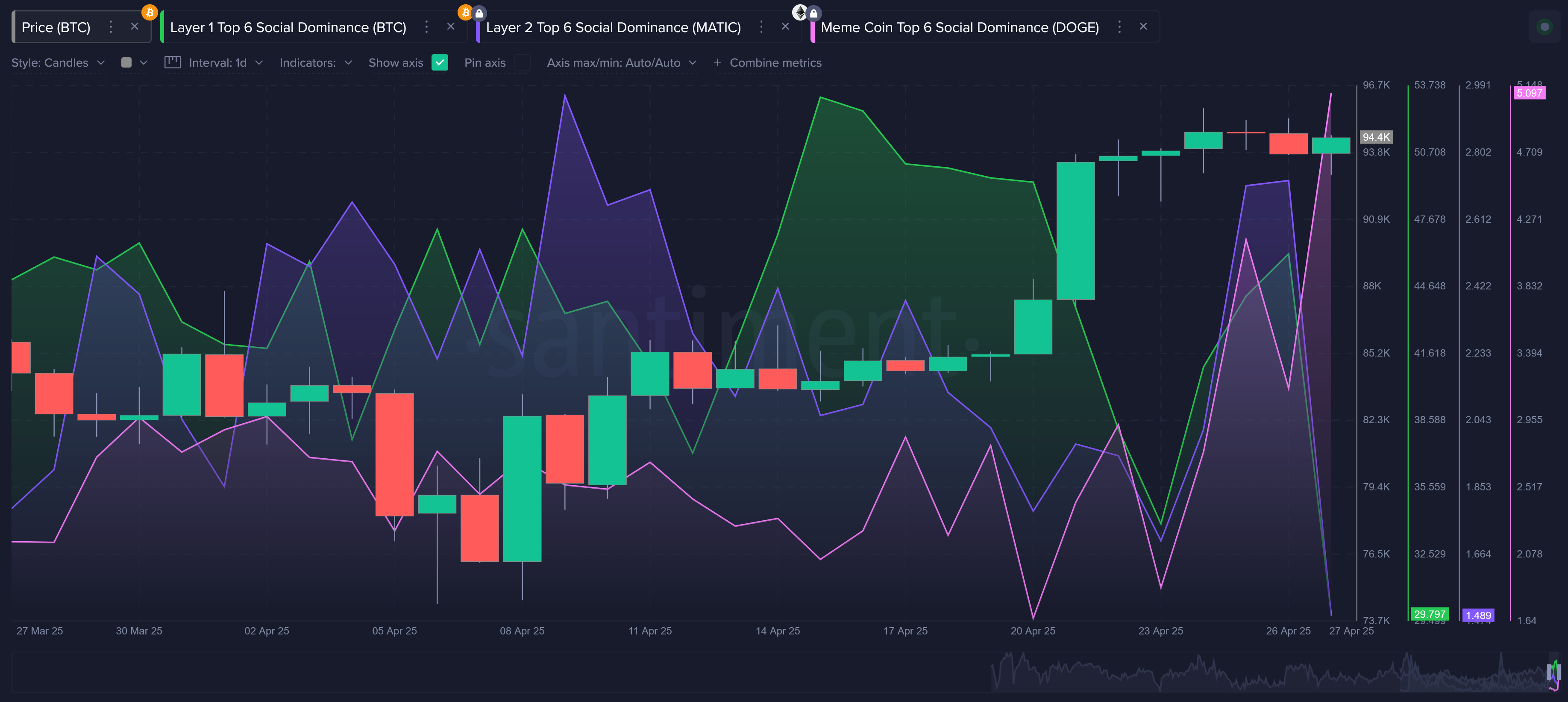

With Bitcoin making a surprise resurgence to the $94K-$96K range over the past five days, it was somewhat predictable that we would see a fairly major profit redistribution toward altcoins thereafter. And that we have.

Over the past week alone, there has been a +10.2% in the entire cryptocurrency sector. And with Bitcoin only making up +7.6%, this means quite a bit of money has collectively surged into smaller market caps to result in this double digit percentage gain week the crypto bulls have been enjoying.

Looking at the trends of what traders are talking about, there has been a sky-high spike in meme coin discussions as well. As usual, when prices begin to soar, traders' interests can't help but veer toward the juicier, higher risk/reward, speculative assets. As the cycle goes, the retail crowd will experience enough losses during a bear cycle (which happened from mid-January to early April) to trade away their altcoins for Bitcoin or stablecoins. But when we see a resurgence in market caps as we have during the second half of April, traders can't resist getting back into a "gamble" mentality.

A few traders typically get in early enough on the meme ride to enjoy a decent enough chunk of the upward momentum these temporary rallies provide. But many others will often jump in just as prices are about to top. And when interest in Bitcoin, and other Layer 1's or 2's are dwindling, while meme coin interest is spiking, it is very often the side that we have entered a greed (toppy) state in the markets.

Besides specifically meme coins, we have seen key words like "altcoin", "altcoins", or "altseason" grow and grow in interest across social media. History has actually shown that the most opportune entries into any sort of altcoin cycle are when the crowd is showing complete disinterest in altcoins. After all, we know that markets consistently move the opposite direction of retail's expectations.

So now that traders are increasingly convinced that "altseason" has arrived, this should be a bit of a red flag, shouldn't it? Traders have constantly had their own interpretations as to what a "bull market", "bear market" actually means. And this is also true when it comes to various definitions of how long a "cycle" or "season" in crypto actually is supposed to be.

Prominent social media figures like @TedPillows takes a fairly rational approach by looking at things from the commonly accepted 4-year cycle perspective. We did see major gains in total crypto market cap in the middle portion of 2017 and 2021. So with the timing factor, combined with rate cuts, Trump's presidency, and ETF approvals, many hopeful and bullish traders buy into this line of thinking.

And speaking of Donald Trump, some attribution of this renewed interest of speculative assets may be due to his own TRUMP campaign. In case you've missed it, the Official TRUMP coin, which began publicly trading just before his inauguration in January, 2025, has seen some renewed interest after being written off as a pump and dump. Why? Well in efforts that were clearly aimed at energizing both his political base and the value of his associated crypto token, he announced that the top 200 holders of the TRUMP coin would be invited to an exclusive event at the White House on May 22, 2025. Additionally, the top 25 holders will receive an exclusive VIP reception and a special tour.

Naturally, this stunt grabbed massive attention across both political and trading circles. Whether viewed as a savvy marketing move or a risky political gamble, the key takeaway for markets is that Trump is actively trying to tie his campaign to crypto culture—and meme coin culture, in particular. Traders, already itching for a narrative to latch onto after Bitcoin’s latest push, found it easy to embrace the hype. The TRUMP coin’s flashy rise (and accompanying media buzz) likely played a part in reigniting traders’ imaginations toward smaller, fast-moving altcoins across the board.

We can see how TRUMP's social volume (and price vs. BTC) skyrocketed just as this announcement was made. The meme coin surged +54% in the first hour after the announcement, and social volume clearly confirms how much this promotions has continually been on traders' radars.

As we head into May, market participants would be wise to keep a close eye on shifting sentiment, Bitcoin’s continued strength, and whether altcoin speculation remains sustainable. History has shown that the transition from rational investing to speculative frenzy can be both swift and punishing. While the opportunities can be massive for early movers, it's equally important to stay grounded and recognize when the crowd’s excitement becomes a signal to proceed with greater caution.

-----

Free two-week trials to Sanbase PRO (to access all mentioned Santiment data in this article, and plenty more) are AVAILABLE HERE!

-----

Disclaimer: The opinions expressed in the post are for general informational purposes only and are not intended to provide specific advice or recommendations for any individual or on any specific security or investment product.